What are Roth Conversions, and Why are they such a Hot Topic?

First, here are some brief definitions that you’ll need to know.

- Roth is a tax-deferred account that is funded with after-tax money. You pay taxes on your income before putting the funds in a Roth account. As long as the conditions are met, you’ll never pay federal taxes on funds in this account, not even when they’re withdrawn.

- IRAs, 401(k), and 403(b) can all be Roth as well, though employer-sponsored plans need to allow Roth for that to be an option.

- Traditional (or “Pre-Tax”) account types are the opposite. You receive income and deposit it into the account before taxes are paid. You get a tax-deduction for contributions in the current year (if conditions are met), but all future withdrawals are fully taxable as ordinary income.

Retirement plan accounts of this nature can be a great way to save for your future. The basic difference is when you’ll pay taxes, and how much you’ll pay.

Roth conversions can be a great way to reduce the uncertainty regarding future tax liability. When done efficiently, Roth conversions can be used to help optimize your lifetime tax liability and help you set up a more efficient legacy.

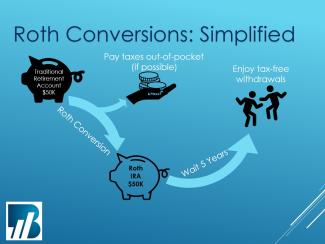

A Roth conversion allows you to take funds from your traditional retirement account(s), and convert those funds over to a Roth account. You’ll have to pay ordinary income tax on any amount converted, but once converted, you’ll enjoy the tax-free benefits of the Roth, provided you abide by the rules.

One of the reasons this has been such a hot topic lately is because the current tax rates are due to sunset after 2025, unless changes are made. This means that most tax brackets will bump up a few percentage points. For example, the 22% tax bracket may become a 24% tax bracket, and others will increase as well.

If that happens, virtually everyone will owe more in taxes, which means we’ll all keep less of our income. This can be especially damaging for those in retirement and on a fixed-income plan, as it means they’ll have to withdraw more from their portfolio every year to maintain their lifestyle and pay their income taxes. Depending on how well they’ve planned for retirement, this could be a minor nuisance, or it could be detrimental.

If their investments are in a Roth account, however, then they won’t need to adjust their withdrawals for increased tax brackets because the withdrawals likely won’t be taxable anyway.

Roth conversions are often recommended to individuals who expect to be in a higher tax bracket in retirement than they are now or are trying to lock in a potentially lower rate now. It’s also generally good practice to pay the taxes on the conversion amount with non-retirement funds if possible.

Another time a Roth conversion may be recommended is when your income is too high for Roth contributions. If you don’t already have an IRA, you can make after-tax contributions to a pre-tax IRA, then immediately convert it over to Roth.

The concept of a Roth conversion is fairly simple and straightforward. If you have funds in a traditional (pre-tax) account, you can move some, or all, of it to a Roth account. You’ll pay ordinary income taxes on the amount converted in the year converted, then won’t owe anymore federal taxes as long as the conditions are met.

However, using Roth conversions for tax planning in an attempt to optimize your lifetime tax liability can be a very complex strategy to implement effectively. It is strongly encouraged that you seek the assistance of a Certified Financial Planner and a tax professional when pursuing this objective.

PS: The basic conditions for Roth accounts to qualify for federally tax-free withdrawals is that the account has to have been open for at least 5 years, and you have attained age 59 ½. For Roth conversions, each conversion has its own separate 5-year timeline (see image below). Ask a professional for more details regarding the specifics of Roth accounts.

|

– Next Blog |

Previous Blog – |

This is not tax advice. Neither The Strategic Financial Alliance nor Bowers Private Wealth Management offer tax or legal advice.