When you combine a strategic asset allocation with a strategic asset location plan, you can optimize your chances for success. I’ll try to break it down for you

Read More

Your ESPP could be a great wealth-building tool—or a financial headache. Learn how to maximize benefits, minimize risks, and decide if it’s right for you. Read

Read More

Two of the most common comments that we get from clients are “I wish I had met you 10 years ago” and “I sure wish I knew some of these things when I was younger

Read More

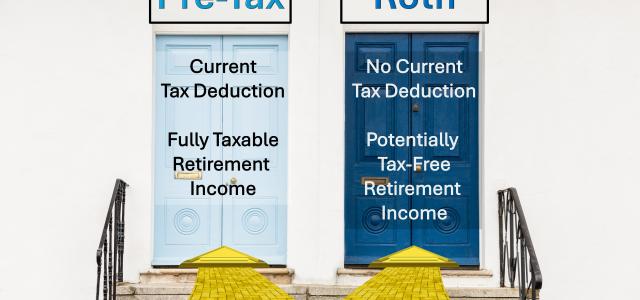

This has been a popular topic that’s been heavily debated since the introduction of Roth capabilities. There’s no “one size fits all” answer to this question

Read More

Financial planning for a couple where one spouse is a business owner and the other works in a high-demand field like IT or Biotech involves unique challenges

Read More

Losing a loved one is an incredibly challenging experience that nearly everyone must go through at some point. Our goal is to provide some general tips to help

Read More

As a small-business owner, your small business is more than just your job – it's your passion, and a legacy you’ve built over years of hard work and dedication

Read More

Your roles and responsibilities can vary significantly based on the type of POA assigned to you and the specific language in the documents.

Read More

Contrary to popular belief, working with a CFP® or other quality financial advisor is so much more than investment management and budgeting. A quality financial

Read More

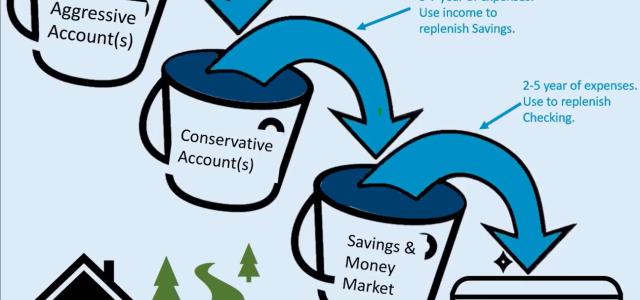

There are a variety of strategies that can be used to help ensure you make the most of your retirement savings and minimize your total lifetime tax liability

Read More

Roth conversions can be a great way to reduce the uncertainty regarding future tax liability. When done efficiently, Roth conversions can be used to help

Read More

What they are and how they're taxed: Restricted Stock Units (RSUs), Employee Stock Purchase Plans (ESPPs), Incentive Stock Options (ISOs), Non-Qualified Stock

Read More