Why We Get Excited About Tax Brackets

If you’ve read our recent newsletter (Thoughts to Take Into 2024), then you’ve likely noticed our enthusiasm for a topic that doesn’t normally spark excitement for others – tax brackets. We’re not CPAs, and we don’t prepare taxes, but we sure do get excited about tax brackets. If you’re at all interested in your financial future, you should too.

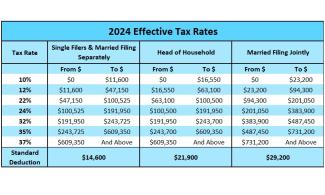

Financial planning inherently revolves around preparing for an uncertain future. With so much uncertainty, it’s nice to know that we can at least count on tax brackets to remain unchanged for a year. These known tax brackets provide a solid foundation for planning for an otherwise unpredictable future.

How We Use Tax Brackets

Using our knowledge of the current tax brackets and a client’s recent income history, we can begin to formulate a working estimation of the client’s expected tax liability for the upcoming year. This is where our fun really begins and where our value to our clients really shines. Each client and situation is unique, so our recommendations will differ greatly between clients, but this is the starting point of many discussions and decisions.

Armed with the client’s expected tax liability, we meet with the client to discuss their expectations for the future and provide our broad-view predictions. From there, we’re able to develop multiple strategies to use in different scenarios, all aimed at lowering the client’s lifetime tax liability. For those with high incomes, we may place more emphasis on reducing their current tax liability, or emphasize future tax savings for those with lower incomes. For those in the middle, or those with unpredictable incomes, we often use a combined approach.

We won’t divulge all of our tax planning strategies, because, frankly, who has time to read all that. We will, however, cover a few of the more common and “basic” strategies.

Reducing Current Tax Liability

To reduce current tax liability, there are a few common strategies. Perhaps the most well-known strategy is contributing to an employer-sponsored retirement account. Contributions to these accounts reduce your taxable income by the amount of the contributions in the year the contributions were made. This is also the case with traditional IRAs (though the contribution limit is typically much lower). For those of you with a Health Savings Account (HSA) option, contributions to those are also deducted from your current tax liability. Some of you may even have the option for deferred compensation plans through your employer, which allows you to trade current income for future income.

For investors, holding onto assets for at least a year before selling for a gain will provide a more favorable tax situation, as long-term capital gains taxes are typically lower than your ordinary income tax rate. While we’re at it, selling assets for a loss can help reduce taxable income under certain circumstances.

Obviously, there are more strategies, especially for business owners and/or accredited investors, but we’ll save that for another time.

Reducing Future Tax Liability

To reduce future tax liability, there are slightly fewer options, as most of us tend to focus more on the present than the future. The most well-known strategy is likely to contribute to a Roth account, either a Roth IRA or Roth employer-sponsored plan. If you make too much for Roth contributions, you may be able to contribute after-tax dollars then convert them to Roth. Although specific rules apply, Roth accounts can be tax-free when funds are withdrawn in retirement. A lesser-known strategy brings back our friend, the HSA. Yes, when used correctly, an HSA can provide for current and future tax benefits (don’t forget to read the blog to learn how!).

For the investors out there, Municipal bonds can provide income that’s free from federal taxes (and state taxes in some circumstances). There’s also tax-loss harvesting and simply buying assets and holding them for the long term. There are some more complex options available too, such as Roth conversions or partnership opportunities for accredited investors, but we’ll save that for an in-person discussion.

Plot Twist

Now for the plot twist, there may be times when it’s recommended that you increase your current tax liability to decrease your lifetime tax liability. Roth conversions are the prime example of this. You increase your current taxable income (and tax liability) to pay less taxes in the future. There are a few others, but they’re more situationally specific.

That’s Enough… For Now

I’m sure you’re likely tired of reading about tax stuff already, and that’s why we’re here for you. We love this stuff, and all the potential opportunities the new tax brackets can open up for our clients. And don’t worry, we won’t bore you with all the specific details (unless you want us to), but will provide you with a thorough overview so you can make well-informed decisions. If you’re interested in reducing your lifetime tax liability, give us a call at the number below for a free introductory conversation. We’ll be happy to see if we can help!

| – Next Blog |

Previous Blog – |